Self-build: Building my house in Spain and Insurance

Julia Jannin2025-03-05T09:59:28+00:00Self-build: Building my house in Spain and Insurance

If you are considering self-building your home, it is advisable to know what self-builder insurance you may need in order to protect you and your house/flat you are building.

In Spain, you will not be obliged to take out insurance for the construction of your house. However, this does not absolve you of your responsibilities, because, even if you are not a professional, the law imposes the same obligations as you are responsible for everything connected with the building site. Civil liability insurance will be particularly important to cover cases of work-related accidents, which can directly affect you , because if you do not have civil liability insurance, you will have to face with your personal assets to cover the damage.

Index

ToggleWhat is the law governing construction insurance in Spain?

First of all, the law that governs housing construction insurance is the Ley de Ordenación de la Edificación (Law 38/1999).

This law highlights 3 types of insurance: :

- Builder's guarantee: to guarantee for one year the compensation of material damages due to defects or deficiencies in the execution affecting the elements of completion or finishing of the works. It may be a deduction by the developer of 5% of the amount of the execution of the work. There is no insurance in Spain to cover this obligation.

- Triennial insurance: to cover for three years the compensation of damage caused by defects in building elements or installations which result in non-compliance with habitability requirements (waterproofing of roofs and terraces, facades and secondary works). This insurance is optional.

- Ten-year insurance “decennial insurance": to guarantee compensation for ten years for material damage caused by defects or faults that originate in or affect foundations, supports, beams, floors, load-bearing walls or other structural elements, and that directly compromise the strength and stability of the building.

However, the guarantee mentioned in point 3 (decennial insurance) will not be required in the case of the individual self-developer of a house for his own use. However, in case of transfer of housing (e.g. sale of the sale of housing), it will be compulsory to take out this guarantee for the remaining time.

If I am self-building, what insurance should I take out?

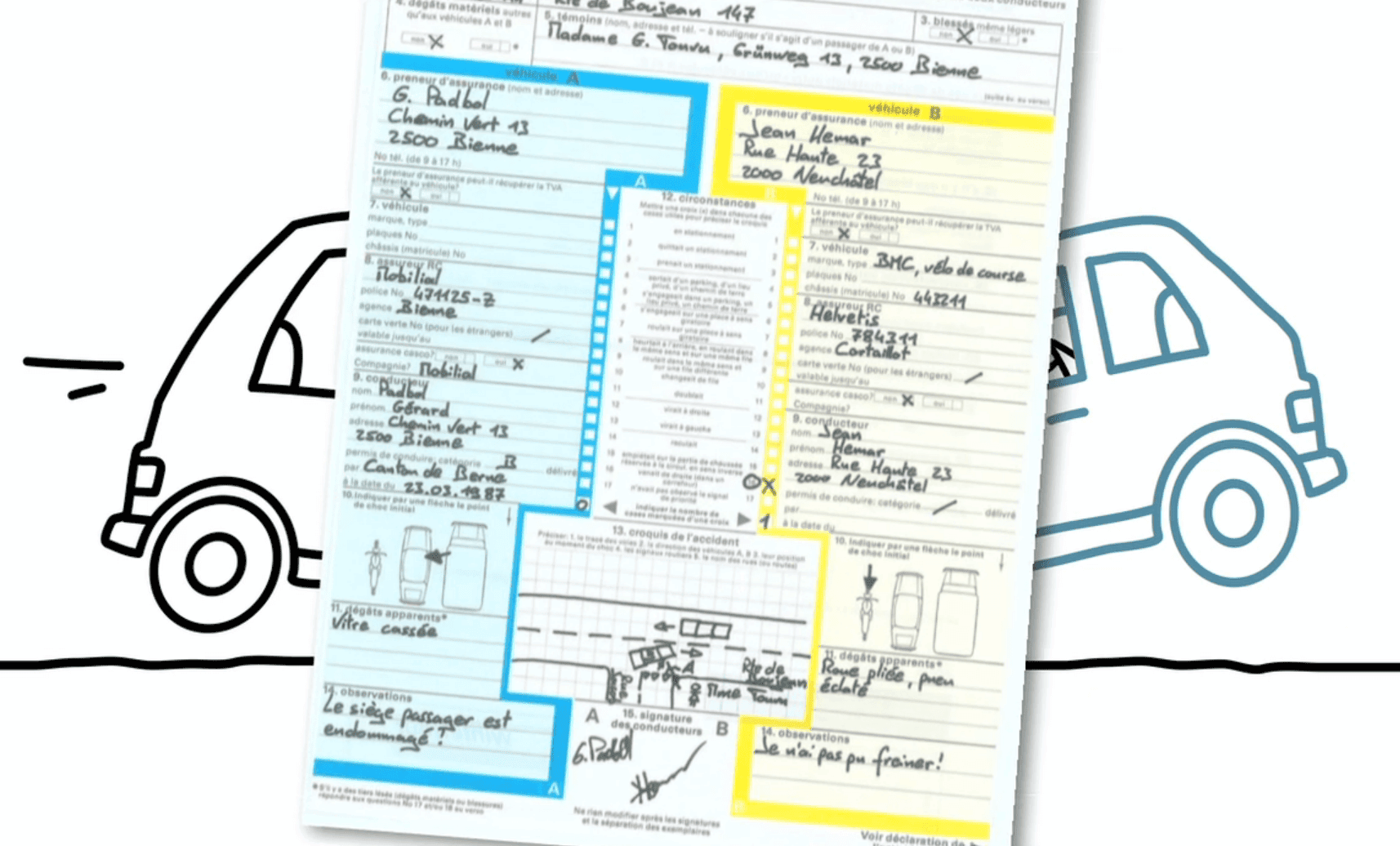

For this reason, the self-builder should consider taking out three types of insurance, even if knowing that there are not compulsory. The insurance will cover you again any injury or damage (liability and physical damages) that could occur while you are working on your site.

1) ALL RISK CONSTRUCTION INSURANCE

If you have approached a bank to finance the construction of your home, the bank may require you to take out "todo riesgo construcción" (TRC) construction insurance. All-risk construction insurance is paid in a single instalment and the work is insured throughout the period of execution.

You can check our article dedicated to All Risks Construction Insurance by clicking here.

2) CIVIL LIABILITY INSURANCE

The promoter of a work (even if it is the rehabilitation or construction of his own house), is responsible for damages caused to a third party by the execution of the work as an agent involved in the construction.

For this reason, even if you share responsibility with other parties such as the architect and builder, it is recommended that you take out civil liability insurance or self-help insurance to ensure that no liability is left uncovered.

3) DECENNIAL INSURANCE

It is recommended to take out decennial insurance for the following reasons:

- to cover structural damage to your house over the next ten years.

- if you wish to sell your house before the 10-year period has elapsed, you will need to take out decennial insurance in order to finalise the sale. Ten-year insurance is much cheaper if it is taken out at the time of the work.

You can request a quote by clicking here.

What types of damage are covered by decennial insurance?

The Decennial Civil Liability insurance will cover claims for 10 years from receipt of the work that may be related to:

- thermal insulation

- wall cracks, swimming pool, etc.

- water infiltration on the facade or roof (lack of waterproofing)

If you do not have an Decennial construction insurance, do not hesitate to ask us for a comparison of the best insurance here

As you can see, insurances for construction are a little bit complicated. Julia Jannin, Managing Director of Inov Expat is an expert. If you have any questions, please do not hesitate to contact her directly by phone on +34 93 268 87 42 or through WhatsApp on +34 627 627 880 or by mail : [email protected]

Personnes vecteur créé par pch.vector - fr.freepik.com

Inov Expat : Who are we?

INOV Expat is an insurance brokerage firm aimed at expatriates in Spain and Portugal

INOV Expat is right there to help you: giving you the best advice on insurance, in English!

In fact, after 15 years, INOV Expat, an insurance brokerage firm, specialises in insurance for French and English-speaking expatriates in Spain and Portugal, at their destinations. As insurance professionals, we’ve signed partnership agreements with the best insurance companies in the market. All INOV Expat consultants are expatriates who will be able to advise you best in the language of your choice (English, French, Russian, Spanish, Portuguese…)

Ask you free quote online : car, health, home, life, travel, others. Look at our website inovexpat.com or contact us by e-mail at [email protected], by telephone at +34.93.268.87.42 or whatsApp +34.627.627.880

![]()