How to complete the accident report form in Spain?

Yohan Leuthold2025-03-05T10:45:11+00:00Index

ToggleWhat are the steps to follow to complete an accident report?

Completing an accident report means an accident or a collision, and it is usually not a pleasure, especially when it is in Spanish. That is why we are here to enlighten you on the procedures.

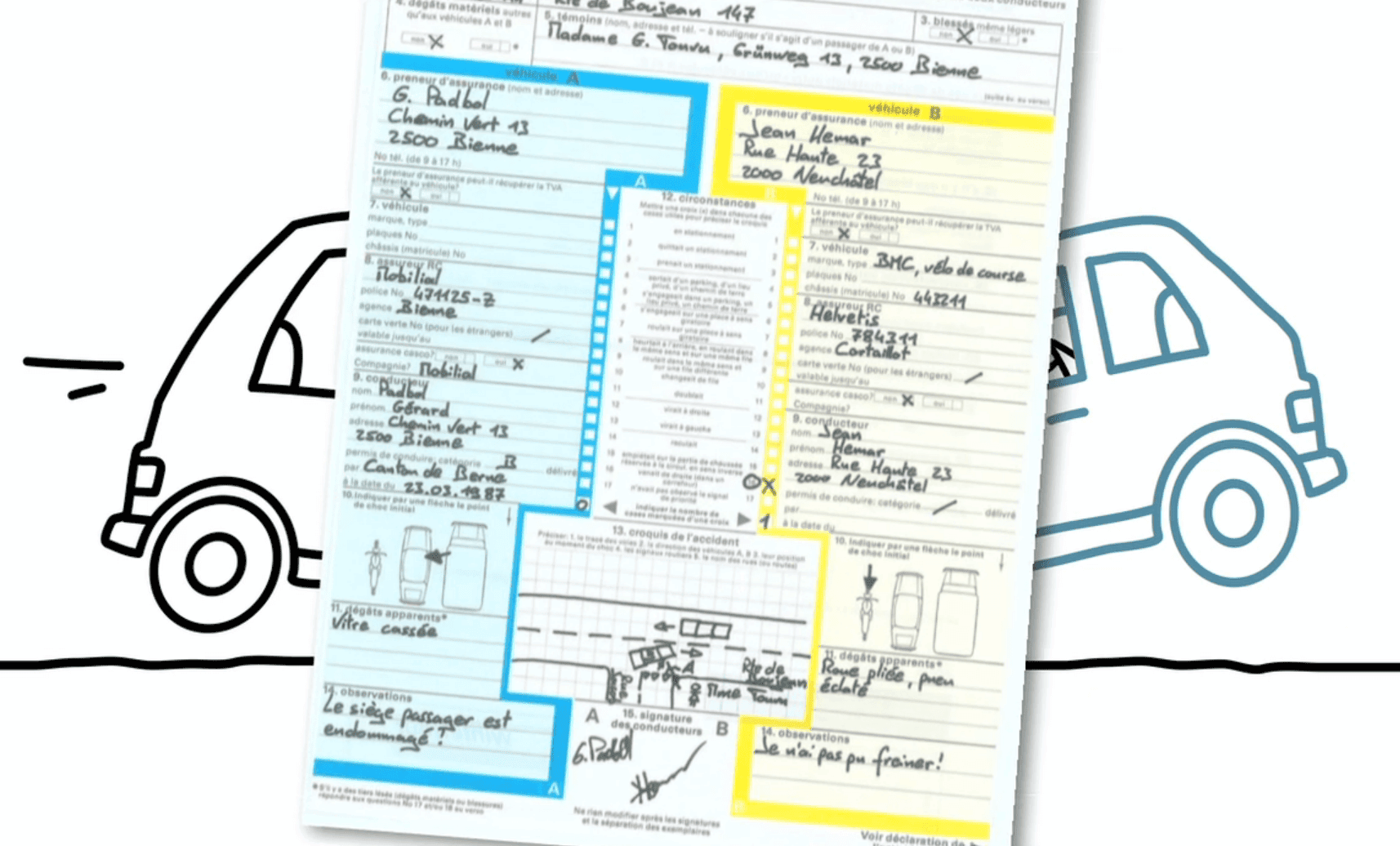

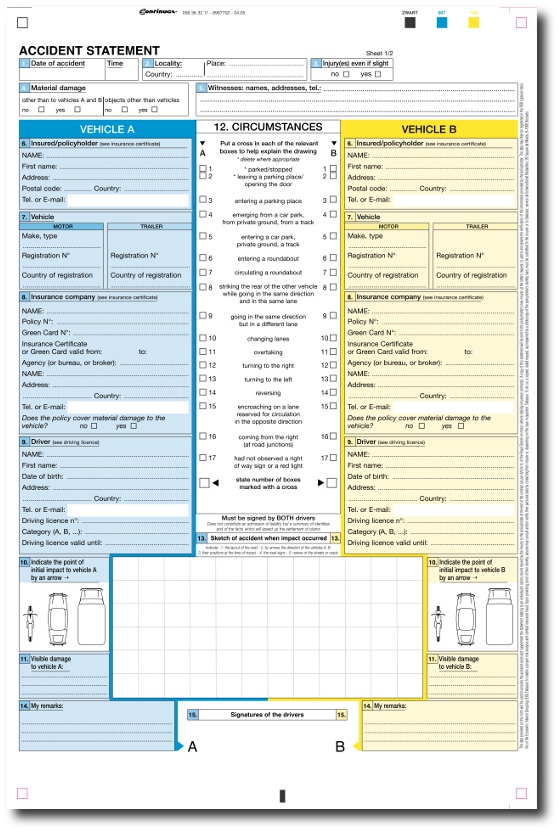

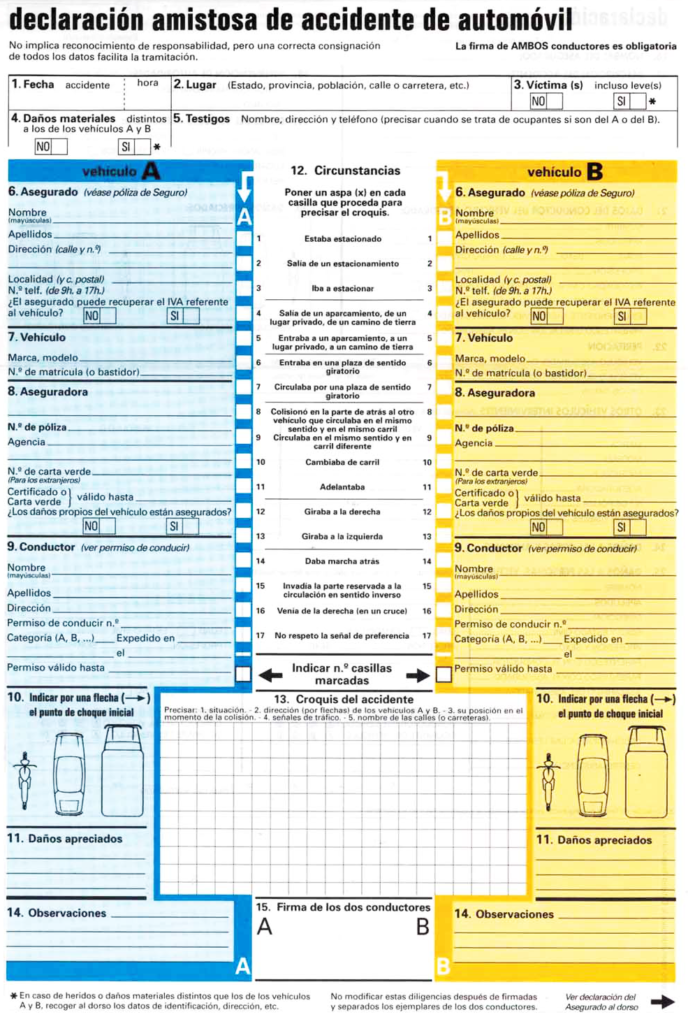

The report are similar throughout Europe. The accident report ("parte de declaración amistosa de accidente" in Spanish) will therefore be valid for the insurance company even if the language is different.

The report allows your insurer, from a precise and objective description of the facts, to get an idea of the accident, the damage and the responsibilities of each. Generally, insurers provide an accident report form with your auto insurance contract.

First of all, you must write the accident report at the accident site, as precisely as possible and indicating the contact details of the people involved in the incident.

If you agree with the information entered on the statement, you must sign it to facilitate the management of the claim by the insurer. Do not sign under pressure from the other driver.

And if you do not agree, your insurer will contact the company of the opposite side in order to find an agreement. Your company will then rely on the police report, damage assessment and other information such as photos or witness statements.

Once complete you take a copy and so does the other party and then send it to your respective insurance companies. You must report the accident to your insurance company or insurance brokers, even if you do not wish to sign the declaration. The maximum time to notify the company is 7 days. The form is universal across the insurance companies and completing this form can really speed up the settlement of a claim.

What to do if you don’t have an accident report form?

If you do not have a report, collect as much information as photos, police statement, date and place of the accident, registration, model and brand of the car but also contact details, from the other driver. In addition the presence of one (or more) witness(s) is useful to corroborate the circumstances of the accident, do not forget to take their contact details. These elements will facilitate the correct management of the claim by your insurer.

If you are facing a hit and run offense, it is important to file a complaint with the police, notify your insurer as soon as possible and inform them of the complaint presented. Do not forget to send the testimonies if you have them as well as any document that can clarify the circumstances of the incident (photos, license plate number, etc.)

To conclude, sign the report only if you agree and directly notify your insurer or broker. The presence of witnesses is important to support your version of the facts and your defense in the event of a dispute. Once the report is completed and signed, it becomes an irrevocable official document, so take the time to fill it out!

Inov Expat : Who are we?

INOV Expat is an insurance brokerage firm aimed at expatriates in Spain and Portugal

INOV Expat is right there to help you: giving you the best advice on insurance, in English!

In fact, after 14 years, INOV Expat, an insurance brokerage firm, specialises in insurance for French and English-speaking expatriates in Spain and Portugal, at their destinations. As insurance professionals, we’ve signed partnership agreements with the best insurance companies in the market. All INOV Expat consultants are expatriates who will be able to advise you best in the language of your choice (English, French, Russian, Spanish, Portuguese…)

Ask you free quote online : car, health, home, life, travel, others. Look at our website inovexpat.com or contact us by e-mail at [email protected], by telephone at +34.93.268.87.42 or whatsApp +34.627.627.880